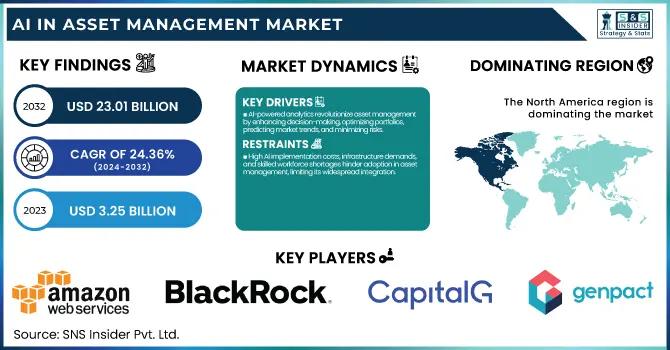

The AI In Asset Management Market was valued at USD 3.25 billion in 2023 and is expected to reach USD 23.01 billion by 2032, growing at a CAGR of 24.36% from 2024-2032.

AI in Asset Management Market is experiencing a transformative phase, redefining how investment decisions are made. As artificial intelligence technologies continue to evolve, the asset management industry is leveraging AI to enhance decision-making, automate tasks, and drive greater operational efficiency. The increasing adoption of machine learning algorithms, predictive analytics, and natural language processing is helping asset managers streamline operations, optimize portfolio management, and mitigate risks. This growth is underpinned by the demand for more accurate data analysis and enhanced investment strategies that AI can offer, creating a significant shift in the asset management landscape.

AI in Asset Management Market is now a key driver of innovation, providing asset managers with new tools to gain a competitive edge. With an expanding pool of data from diverse sources, including market trends, social media, and financial reports, AI systems can process vast amounts of information at lightning speed. This enables better forecasting, improved customer experiences, and more informed investment decisions. The integration of AI into asset management is becoming a necessity for firms striving to remain at the forefront of the industry, signaling a new era of smarter, data-driven investment management.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/5988

Market Keyplayers:

Amazon Web Services, Inc. (Amazon SageMaker, AWS AI Services)

BlackRock, Inc. (Aladdin, FutureAdvisor)

CapitalG (Investments in AI-focused companies, Strategic AI partnerships)

Charles Schwab & Co., Inc. (Schwab Intelligent Portfolios, AI-driven financial advice tools)

Genpact (Cora Finance Analytics, AI-powered asset management solutions)

Infosys Limited (Infosys Nia, AI-driven financial services solutions)

International Business Machines Corporation (IBM Watson, IBM Cloud Pak for Data)

IPsoft Inc. (Amelia, 1Desk)

Lexalytics (Salience, Lexalytics Intelligence Platform)

Microsoft (Azure AI, Microsoft Power BI)

TABLEAU SOFTWARE, LLC (Tableau Desktop, Tableau Server)

Next IT Corp. (Alme, AI-powered virtual assistants)

S&P Global (Market Intelligence Platform, Kensho AI)

Salesforce, Inc. (Einstein Analytics, AI-driven CRM solutions)

FIS (FIS Asset Management Solutions, FIS Data Integrity Manager)

ION Group (ION Treasury, ION Analytics)

Synechron (Neo AI Platform, AI Data Science Accelerators)

SAP SE (SAP Cash Application, SAP Leonardo)

HighRadius (Autonomous Receivables, AI-powered Treasury Management)

Axyon AI (Axyon IRIS, AI Investment Strategies)

Upstart (AI-powered Lending Platform, Upstart Auto Retail)

Capgemini SE (AI in Wealth Management Solutions, AI-powered Financial Services)

BayCurrent Inc. (AI Consulting Services, AI-driven Financial Solutions)

MGX Fund Management Limited (AI Investment Fund, Global AI Infrastructure Investment Partnership)

Market Analysis

The market for AI in asset management is witnessing robust growth, driven by advancements in machine learning, AI-based predictive analytics, and the increasing need for automation. Major asset management firms are increasingly investing in AI tools to gain insights from big data and improve their investment strategies. The market is also being fueled by the growing importance of risk management, portfolio optimization, and personalized financial advice, which AI helps to address with greater precision.

Scope

AI in asset management is expected to expand across multiple facets, including portfolio management, risk assessment, fraud detection, and client interactions. With AI-enabled tools automating routine tasks and delivering actionable insights, the overall scope of AI in asset management spans both traditional investment models and emerging fintech applications, including robo-advisory services and algorithmic trading platforms.

Trends

Automation of Investment Processes: AI-driven platforms are automating portfolio management and trading, reducing human error, and increasing efficiency.

Enhanced Risk Management: AI helps predict potential market risks by analyzing vast data sets and spotting trends, enabling better risk mitigation strategies.

AI-Powered Customer Experiences: AI tools are personalizing client interactions, providing tailored investment recommendations and improving service delivery.

Integration of Natural Language Processing (NLP): NLP is being used to analyze news, reports, and other unstructured data, offering deeper insights into market movements.

Algorithmic Trading and Robo-Advisors: The rise of AI-powered robo-advisors and trading algorithms is transforming how investments are made and managed, offering increased returns and optimized strategies.

Data-Driven Decision Making: AI enables real-time data analysis, empowering asset managers to make more informed and timely investment decisions.

Future Prospects

The future of AI in asset management looks promising, with continued advancements in AI technology expected to enhance decision-making capabilities. The integration of AI into asset management is set to expand as firms increasingly prioritize data-driven, automated solutions. The next decade will likely witness an even more sophisticated blend of AI tools and human expertise, leading to a new level of efficiency and effectiveness in asset management practices.

Access Complete Report: https://www.snsinsider.com/reports/ai-in-asset-management-market-5988

Conclusion

The AI-driven transformation of the asset management market is just beginning. With the integration of advanced technologies, asset managers are poised to achieve better investment outcomes, streamline operations, and enhance client satisfaction. As the market continues to evolve, AI will undoubtedly play a crucial role in reshaping the future of investment strategies, making the industry more agile, data-driven, and competitive.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Write a comment ...