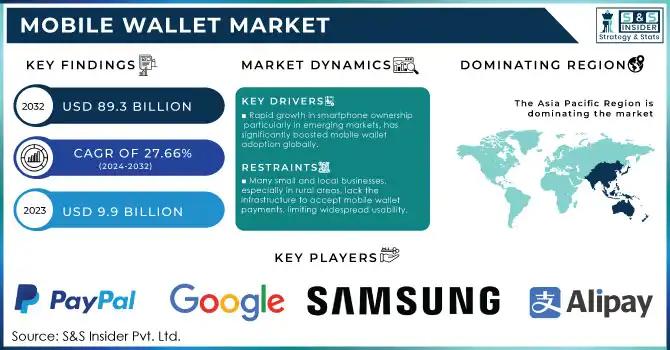

The Mobile Wallet Market was valued at USD 9.9 billion in 2023 and is expected to reach USD 89.3 Billion by 2032, growing at a CAGR of 27.66% over 2024-2032.

The Mobile Wallet Market Empowering the Future of Digital Transactions is witnessing accelerated growth as consumers and businesses shift toward cashless and contactless payment solutions. The rising penetration of smartphones, faster internet connectivity, and increasing focus on convenience and security are driving the widespread adoption of mobile wallets across sectors.

The Mobile Wallet Market Empowering the Future of Digital Transactions is expanding rapidly with financial institutions, retailers, and technology companies offering innovative solutions to meet evolving consumer demands. Mobile wallets are no longer limited to payments but now encompass loyalty programs, ticketing, and even digital identity management, shaping the future of everyday transactions.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3822

Market Keyplayers:

PayPal - PayPal Mobile Wallet

Apple Inc. - Apple Pay

Google - Google Pay

Samsung Electronics - Samsung Pay

Alipay (Ant Group) - Alipay Mobile Wallet

WeChat (Tencent) - WeChat Pay

Amazon - Amazon Pay

Visa Inc. - Visa Checkout

Mastercard - Mastercard PayPass

Square Inc. - Square Wallet

Paytm - Paytm Wallet

Venmo (owned by PayPal) - Venmo Mobile Wallet

MobiKwik - MobiKwik Wallet

Cash App (Square Inc.) - Cash App Wallet

Lazada (Alibaba Group) - Lazada Wallet

TrueMoney (Ascend Money) - TrueMoney Wallet

Samsung Electronics - Samsung Pay

Revolut - Revolut Mobile Wallet

Zelle (Early Warning Services) - Zelle Payment App

Razer - Razer Pay

Market Analysis

The market is experiencing robust growth across developed and emerging economies alike, fueled by the convenience, speed, and enhanced security features offered by mobile wallets. Asia-Pacific leads the global market, particularly driven by rapid digital adoption in China and India.

Scope

Mobile wallets serve multiple industries including retail, banking, transportation, and healthcare. Their applications range from peer-to-peer transfers to utility bill payments, ensuring broad usability and growing integration into daily life.

Key Trends

Surge in NFC-based mobile payment technologies

Growing partnerships between banks and tech startups

Rise of biometric authentication for enhanced security

Increasing integration with loyalty and rewards programs

Market Forecast

The mobile wallet market is projected to maintain a strong growth trajectory, with adoption rates expected to rise sharply over the next five years. Expanding financial inclusion initiatives and advancements in fintech solutions are likely to further propel market momentum.

Future Prospects

The future of the mobile wallet market looks promising, with innovation focusing on seamless user experience, cross-border transactions, and enhanced data security. Emerging markets present significant opportunities for further expansion as mobile-first economies continue to evolve.

Access Complete Report: https://www.snsinsider.com/reports/mobile-wallet-market-3822

Conclusion

The mobile wallet market stands at the forefront of the digital finance revolution, transforming how consumers interact with money. With rapid technological advancements and growing consumer trust, mobile wallets are set to redefine the future of payments globally.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Write a comment ...